Presented by Jones Partners

2023-2024 Projections and Observed Numbers

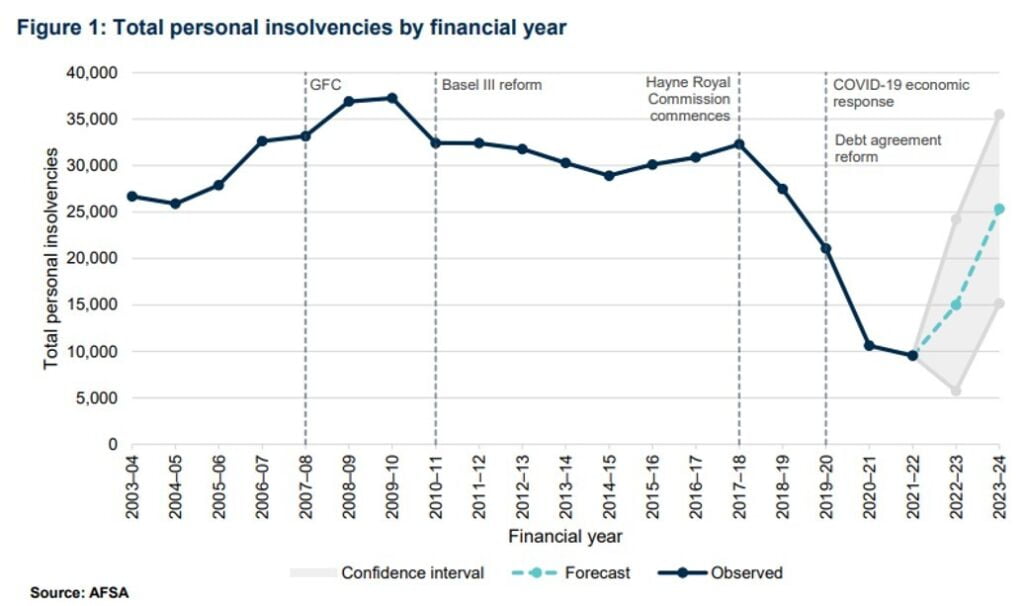

The above graph depicts the projected increase in personal insolvencies for 2023 and 2024. AFSA were predicting a significant increase for the 2022-2023 FY, with a forecast of 15,000 incidents of personal insolvency. The actual numbers fell significantly short, reaching a total of 9930. A large proportion of these personal insolvencies were business related. Personal insolvencies have yet to return to pre-covid levels.

Predictions for 2023-2024 FY

It is impossible to say with complete certainty when cases of personal insolvency will significantly increase. Numbers should eventually return to pre-covid levels, but for now we are experiencing a time lag. The number of personal insolvencies is directly correlated to the debt recovery approach adopted by the Australian Tax Office (“ATO”). There is evidence the ATO is becoming more pragmatic in its debt collection, after a period of significant inactivity during the pandemic. There is an estimated $50 billion in accrued tax debt, and it is only a matter of time before the ATO comes to collect. Personal insolvencies will likely increase in 2024 as economic conditions become increasingly hostile.

Keen to read more? See our insights on corporate insolvency statistics