February 2024 Totals

664 bankruptcies

308 debt agreement

8 personal insolvency agreement

2 deceased estate

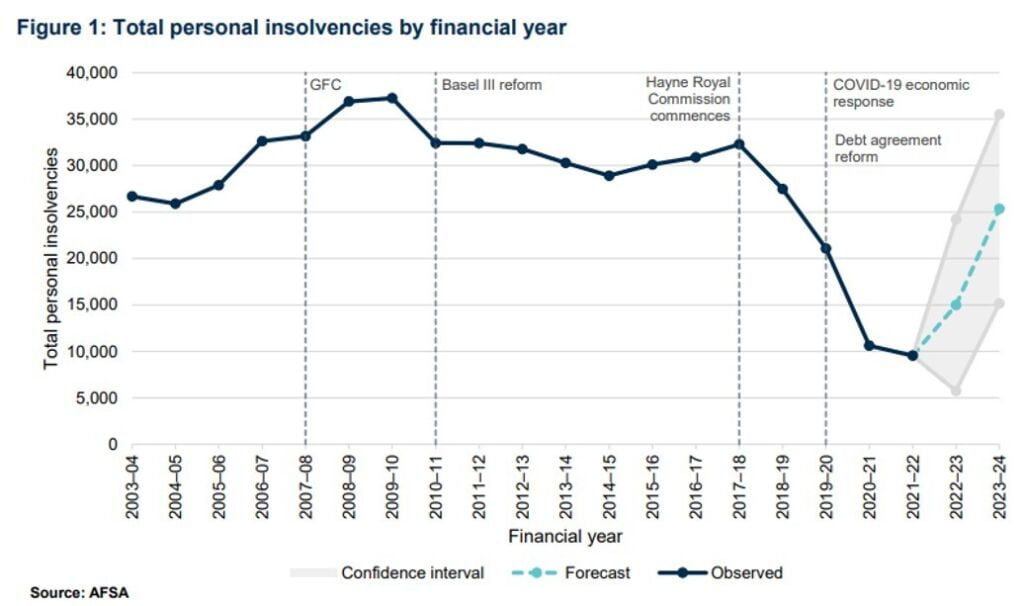

Personal insolvency trends

Personal insolvency statistics continue to fall well behind the projections and timeline suggested by AFSA. The most common industry for affected individuals continues to be construction, healthcare, transport and retail trade. Costs remain high and consumers continue to cut back on discretionary spending. Despite these challenges, figures have only increased slightly, and remain relatively low.

Why the delay?

For a long time, AFSA has been projecting a significant increase in personal insolvencies. The number of personal insolvencies is closely tied to the economic conditions, most importantly the cash and unemployment rate. Despite the high cash rate of 4.35%, unemployment has remained quite low, currently sitting at 4.1 per cent. Unemployment will need to rise before we see a significant increase in personal insolvencies. It is also likely that the RBA will want to see unemployment rise before it begins reducing the cash rate.

AFSA are confident this increase will materialise, it’s only a matter of time.